Bitcoin Usd Btc

2140; the record keeping will then be rewarded by transaction fees only. Computing power is often bundled together by a Mining pool to reduce variance in miner income. Individual mining rigs often have to wait for long periods to confirm a block of transactions and receive payment. In a pool, all participating miners get paid every time a participating server solves a block. This payment depends on the amount of work an individual miner contributed to help find that block. Since you are trading crypto CFDs and not actually purchasing the digital currency, you can profit from both rising and falling markets. There is a realistic expectation of this happening with major institutions now among the big players in cryptocurrencies as well as the underlying blockchain technology.

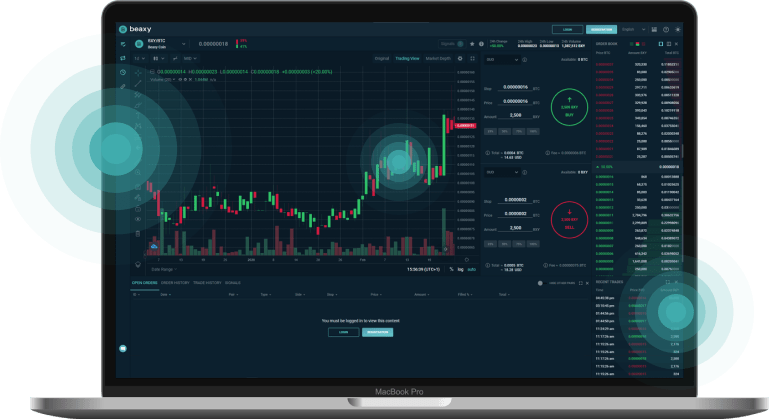

But we shouldn’t forget that they have also created the first blockchain — the only kind of digital network where cryptocurrencies can operate. Even before BTC developers launched the first distributed ledger, the concept of blockchain was described by different computer scientists. But even for those who don’t discover using their own high-powered computers, anyone can buy and sell bitcoins at the bitcoin price they want, typically through online exchanges like Coinbase https://www.beaxy.com/ or LocalBitcoins. Instant non-custodial limitless cryptocurrency trading platform – exchange Bitcoin to Ethereum, Ripple, Bitcoin Cash, XMR at the best rates, no account needed! A blockchain is a digital ledger recording cryptocurrency transactions, maintaining records referred to as ‘blocks’ in a linear, chronological order. Bitcoins can be transferred from a bitcoin exchanges to one of many bitcoin wallets, ranging from online options to ‘cold storage’.

Coinbases Stock Selloff Is way Overblown For These Reasons, Analyst Says

On 30 November 2020, the bitcoin value reached a new all-time high of $19,860, topping the previous high of December 2017. Alexander Vinnik, founder of BTC-e, was convicted and sentenced to five years in prison for money laundering in France while refusing to testify during his trial. In December 2020 Massachusetts Mutual Life Insurance Company announced a bitcoin purchase of US$100 million, or roughly 0.04% of its general investment usd to btc account. Currency traders are familiar with the major currency pairs, and often a good number of the minor pairs. More experienced traders are also likely familiar with a number of exotic pairs as well. But the BTC/USD pair is something of a mystery to currency traders, and that’s because one of the components isn’t a traditional fiat currency. BTC/USD refers to the pairing of the leading cryptocurrency Bitcoin with the U.S. dollar.#LunarOpinions Would you recommend trading on Beaxy?

— johansyah coga (@johan_syah) March 1, 2022

90.6% Yes

4.274% No

5.128% No opinion

Data represents opinions given on LunarCrush over the last 24 hours.https://t.co/vOlKvVnhjW

General Market Sentiments

This compared to ₿4,131 that had laid dormant for a year or more, indicating that the vast majority of the bitcoin volatility on that day was from recent buyers. These events were attributed to the onset of the COVID-19 pandemic. Research produced by the University of Cambridge estimated that in 2017, there were 2.9 to 5.8 million unique users using a cryptocurrency wallet, most of them using bitcoin. On 15 July 2017, the controversial Segregated Witness software upgrade was approved (“locked-in”). Segwit was intended to support the Lightning Network as well as improve scalability. SegWit was subsequently activated on the network on 24 August 2017. The bitcoin price rose almost 50% in the week following SegWit’s approval. On 21 July 2017, bitcoin was trading at $2,748, up 52% from 14 July 2017’s $1,835. Supporters of large blocks who were dissatisfied with the activation of SegWit forked the software on 1 August 2017 to create Bitcoin Cash, becoming one of many forks of bitcoin such as Bitcoin Gold.Beaxy recent activity:

— johansyah coga (@johan_syah) March 1, 2022

Volume Rank: 320 out of 583

24H Volume: $20.05K

30D Volume: $3.43Mhttps://t.co/vbIwjLGg9B$beaxy #LunarCrush

The World’s Most Popular Currency Tools

Bitcoin Core in 2015 was central to a dispute with Bitcoin XT, a competing client that sought to increase the blocksize. Over a dozen different companies and industry groups fund the development of Bitcoin Core. Checkpoints which have been hard coded into the client are used only to prevent Denial of Service attacks against nodes which are initially syncing the chain. For this reason the checkpoints included are only as of several years ago. A one megabyte block size limit was added in 2010 by Satoshi Nakamoto. This limited the maximum network capacity to about three transactions per second. Since then, network capacity has been improved incrementally both through block size increases and improved wallet behavior. A network alert system was included by Satoshi Nakamoto as a way of informing users of important news regarding bitcoin.- The first wallet program, simply named Bitcoin, and sometimes referred to as the Satoshi client, was released in 2009 by Satoshi Nakamoto as open-source software.

- Intraday Data provided by FACTSET and subject to terms of use.

- Individual blocks, public addresses and transactions within blocks can be examined using a blockchain explorer.

Bitcoins are created as a reward for a process known as mining. They can be exchanged for other currencies, products, and services. Bitcoin has been criticized for its use in illegal transactions, the large amount of electricity used by mining, price volatility, and thefts from exchanges. Some investors and economists have characterized it as a speculative bubble at various times. Others have used it as an investment, although several regulatory agencies have issued investor alerts about bitcoin. While institutional money is a major positive for cryptocurrencies, the launch of a Bitcoin ETF would go a long way in rubberstamping its legitimacy. Investors were confident that 2021 would be the year that a Bitcoin ETF would finally start trading, but the SEC has routinely frustrated several proposals to launch one. Nonetheless, there already exists an ETF for crypto mining and mining infrastructure companies trading on the NYSE; investors can only be hopeful a true Bitcoin ETF is on the way. The huge breakthrough moment was the first exchange of digital currency on the exchange.

How much does it cost for 1 Bitcoin?

First, we find that the average production cost of a bitcoin using various ASIC models is about $9,000. Secondly, we find that the approximate average cost to mine one bitcoin considering hardware investment is around $13,000.

Popular Currencies

In ten years this value increased by million times and the last highest point the BTC has reached was nearly $62,000. If you look at the Trade page on the CEX.IO website, you can see the chart representing the fluctuations of BTC market value. There are different pillows called ‘candlesticks’ that show the uptrend and downtrend . When you look at the right part of the graph, you can see the price indexes. Put the cursor on the latest candle and to find the current BTC in USD exchange rate. This is an approximate price at which you can buy Bitcoins for now. However, keep in mind this value can change dramatically even the next minute. Investors who have their bitcoin on exchanges or wallets that support the new currency will soon see their holdings double, with one unit in bitcoin cash added for every bitcoin. But that doesn’t mean the value of investors’ holdings will double. Unlike US dollars, whose buying power the Fed can dilute by printing more greenbacks, there simply won’t be more bitcoin available in the future. That has worried some skeptics, as it means a hack could be catastrophic in wiping out people’s bitcoin wallets, with less hope for reimbursement. No one controls these blocks, because blockchains are decentralized across every computer that has a bitcoin wallet, which you only get if you buy bitcoins. The fastest crypto exchange in the world powered by blockchain.com. The only place to buy, sell, and trade Bitcoin Cash in microseconds. To calculate the exchange rate for a given cryptocurrency in US Dollars and Euros , we use the Bids directly from our approved exchanges. The private key can be printed as a series of letters and numbers, a seed phrase, or a 2D barcode. Usually, the public key or bitcoin address is also printed, so that a holder of a paper wallet can check or add funds without exposing the private key to a device. The U.S. Commodity Futures Trading Commission has issued four “Customer Advisories” for bitcoin and related investments.

But that doesn’t mean the value of investors’ holdings will double. Unlike US dollars, whose buying power the Fed can dilute by printing more greenbacks, there simply won’t be more bitcoin available in the future. That has worried some skeptics, as it means a hack could be catastrophic in wiping out people’s bitcoin wallets, with less hope for reimbursement. No one controls these blocks, because blockchains are decentralized across every computer that has a bitcoin wallet, which you only get if you buy bitcoins. The fastest crypto exchange in the world powered by blockchain.com. The only place to buy, sell, and trade Bitcoin Cash in microseconds. To calculate the exchange rate for a given cryptocurrency in US Dollars and Euros , we use the Bids directly from our approved exchanges. The private key can be printed as a series of letters and numbers, a seed phrase, or a 2D barcode. Usually, the public key or bitcoin address is also printed, so that a holder of a paper wallet can check or add funds without exposing the private key to a device. The U.S. Commodity Futures Trading Commission has issued four “Customer Advisories” for bitcoin and related investments.The Xe Rate Alerts will let you know when the rate you need is triggered on your selected currency pairs.

We set exchange rates for non-USD and non-EUR currencies indirectly using Open Exchange Rates. In the future, as digital currency markets in other currencies mature, BitPay will use those markets directly. In March 2013 the blockchain temporarily split into two independent chains with different rules due to a bug in version 0.8 of the bitcoin software. The two blockchains operated simultaneously for six hours, each with its own version of the transaction history from the moment of the split. Normal operation was restored when the majority of the network downgraded to version 0.7 of the bitcoin software, selecting the backwards-compatible version of the blockchain. As a result, this blockchain became the longest chain and could be accepted by all participants, regardless of their bitcoin software version.

Which crypto will explode?

You can’t go wrong with Ethereum. It dominates much of the crypto market, approximately 18.49% according to CoinMarketCap. Ethereum is perhaps the most explosive cryptocurrency on this list. If Ethereum explodes again in 2022, it will likely be a very big explosion.